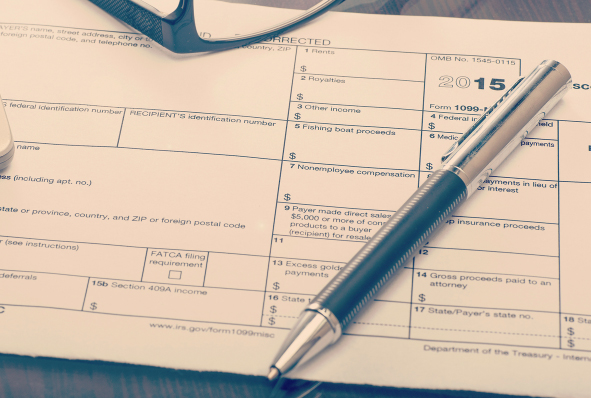

You should tax-a-website-manager using an IRS Form-1099 when he or she was paid $600 or more for their services during a single calendar year, and he or she is not a full-time employee. A website manager can also be referred to as a webmaster, web developer, site author, web coordinator or web publisher. Whether contributing content, technology or a combination of services, the IRS doesn’t care and you may be held responsible for not issuing a Form-1099 for your website manager.

When to issue your website manager the Form-1099

Any worker who starts work on a project of yours – whether technology-related or not – should be asked to complete the IRS Form W-9 on the first day of work. This is the form you will use to submit the IRS Form-1099. On the W-9 the name of the contractor, business and the tax identification information (or Social Security #) will be identified along with address and signature of the contractor. Do not wait until after the contract finishes a job to issue the W-9.

Form W-9: DOWNLOAD

Place website manager income in Box 7 within the Form 1099-MISC.

With the completed IRS Form W-9, you are now ready to use the information provided by the website manager to issue the IRS Form 1099 and send a copy of that IRS Form 1099-MISC to the website manager. A copy must be sent, according to the IRS, by January 31st of the following year, and you must file a copy with the IRS by February 28th of the following year. The IRS deadline for electronic filing of a Form 1099 for a website manager is March 31 of the following year.

There are many ways to check your work when working with W-9 forms, and having a CPA or other tax expert look over your paperwork filed for the Website Manager is always a smart thing to do. Also, be sure to retain copies of any tax documentation submitted to or received from your contractors.

Form-1099: DOWNLOAD

See website manager job descriptions: CLICK HERE

According to Salary.com the average yearly Website Manager compensation was $93,921 for 2016. The range of a website manager’s salary is generally between $70k – $110k.

USEFUL LINKS ABOUT SUBMITTING TAX FORMS FOR WEBSITE MANAGERS:

- SUBCONTRACTOR OR EMPLOYEE? CLICK HERE TO FIND OUT

- RED FLAGS THAT RAISES THE CHANCE OF AUDIT: CLICK HERE

- SIX COMMON MISTAKES MADE ON A 1099 FORM: CLICK HERE

- HOW THE IRS DECIDES NEGLIGENCE OR MISTAKES: CLICK HERE

You should issue the IRS Form 1099-MISC for your website manager when he or she was paid $600 or more for their services during a single calendar year.