What flavor is your website?

Hedge funds and institutional traders may no longer have the option of paying a premium to Nasdaq for access to an API that includes consolidated real-time market data pertaining to major US exchanges.

The Nasdaq Securities Information Processor (SIP) has been in the cross hairs of government regulators and anyone impacted by a three-hour Nasdaq outage caused by the SIP last year on August 22nd. “Events vastly exceeded the SIP’s planned capacity, which caused its failure and then revealed a latent flaw in the SIP’s software code,” the Nasdaq report said.

When was the last time you told one of your clients “a software flaw” caused the primary and backup system outage?

By quickly responding to market data movement, traders use the Nasdaq SIP to beat others to the punch. These electronic traders also use the mass of information to predict future stock price movements and adjust their trading algorithms accordingly.

Nasdaq has decided they no longer want to support the SIP for consolidated quote and trade data for stocks, unless major resources can be found for upgrading the legacy ITCH protocol feed and Windows 2003 operating system. Although revenue from the SIPs was $400 million for 2013, the risks are too high, said the report.

The winner will be NYSE Euronext which runs two SIPs on behalf of the nation’s exchanges, albeit at a premium and with the superior infrastructure to justify the higher cost to traders.

The loser will be the small traders, where consolidation could mean a virtual monopoly for NYSE Euronext. At a time when regulators want more transparency spread across more participants, one could guess that there will be a cash infusion to rejuvenate the retiring Nasdaq SIP. Nasdaq says they are open to any and all “suggestions,” or what sounds like a stipulation that someone else needs to chip the money for an upgrade.

The cancellation of the Nasdaq market data service is not scheduled to take effect until 2016.

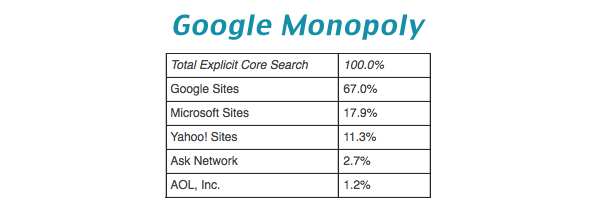

When was the last time you “Yahooed” a restaurant? Howabout “Binging” someone to learn more about them? Maybe, never. Google’s search engine monopoly corners online advertising so that there is a lack of competition from other companies. Characterized by Google’s singular power to control where customers turn, their monopoly provides the ability to charge what they want, when they want to. The European Union agrees Google needs to stop hogging the market, and they issued a list of Google’s monopolistic practices following a two-year probe:

Google hogs specialized search – Google prominently displays links to its own specialized search services within its web search results and does not inform users of this favorable treatment.

Google hogs content usage – Google uses without consent content from competing specialized search services in its own offerings. Google thereby benefits from the investments of competitors, sometimes against their explicit will.

Google hogs with exclusivity agreements with publishers – Google requires web site owners to display no or only a limited amount of online search advertisements from Google’s competitors, which reduces the choice of online search advertisements they can offer to users of their web sites.

Google hogs by creating contractual restrictions on the portability of Google’s AdWords – Google contractually restricts the possibility to transfer online search advertising campaigns away

Bing accounts for 17.9 percent of search share in the US but they may be gaining ground on Google. Without irony, Microsoft’s CEO recently called on the US Government to break up Google’s monopoly on search engines. Nevermind their long battle with the federal government over their own past monopolies.

Governments won’t likely be successful in breaking up the mega-company that is Google, precisely because there is nobody doing as good as job. We Google because no service has proven better at search results. Nonetheless, calling a monopoly out doesn’t meant it should be broken up. In fact, the break up will occur through the natural shift in user preferences and methods for accessing search results. There will be new entrants coming into the market attempting to disrupt Google’s corner on advertising and searching. The introduction of mobile technology and new gaming systems, for example, demonstrate the move away from Google already. Bing is featured as the default search engine on the Xbox 360. Geographically Google is, arguably, a lost leader in Asian markets already. Understanding that Google does not monopolize all countries should be an indication of how other models are evolving market standards.

By continuing to use the site, you agree to the use of cookies. more information

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.