Hedge funds and institutional traders may no longer have the option of paying a premium to Nasdaq for access to an API that includes consolidated real-time market data pertaining to major US exchanges.

The Nasdaq Securities Information Processor (SIP) has been in the cross hairs of government regulators and anyone impacted by a three-hour Nasdaq outage caused by the SIP last year on August 22nd. “Events vastly exceeded the SIP’s planned capacity, which caused its failure and then revealed a latent flaw in the SIP’s software code,” the Nasdaq report said.

When was the last time you told one of your clients “a software flaw” caused the primary and backup system outage?

By quickly responding to market data movement, traders use the Nasdaq SIP to beat others to the punch. These electronic traders also use the mass of information to predict future stock price movements and adjust their trading algorithms accordingly.

Nasdaq has decided they no longer want to support the SIP for consolidated quote and trade data for stocks, unless major resources can be found for upgrading the legacy ITCH protocol feed and Windows 2003 operating system. Although revenue from the SIPs was $400 million for 2013, the risks are too high, said the report.

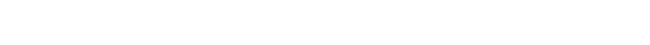

The winner will be NYSE Euronext which runs two SIPs on behalf of the nation’s exchanges, albeit at a premium and with the superior infrastructure to justify the higher cost to traders.

The loser will be the small traders, where consolidation could mean a virtual monopoly for NYSE Euronext. At a time when regulators want more transparency spread across more participants, one could guess that there will be a cash infusion to rejuvenate the retiring Nasdaq SIP. Nasdaq says they are open to any and all “suggestions,” or what sounds like a stipulation that someone else needs to chip the money for an upgrade.

The cancellation of the Nasdaq market data service is not scheduled to take effect until 2016.